Estimated Tax Due Dates 2024 For Corporations Municipal. However, the exceptions for tax day are: Mark your calendar for these deadlines in 2024, based on.

For “regular” corporations (i.e., c corporations) that operate on a calendar year, their federal income tax return for the 2023 tax year is due on april 15, 2024. June 11, 2024 · 5 minute read.

Individuals, Sole Proprietors, And C Companies Must File Taxes On That Day.

The first quarterly tax payment of 2024 was due april 15.

For “Regular” Corporations (I.e., C Corporations) That Operate On A Calendar Year, Their Federal Income Tax Return For The 2023 Tax Year Is Due On April 15, 2024.

When are the quarterly estimated tax payment deadlines for 2024?

Connecticut Governor Ned Lamont Has Signed Legislation Extending To 30 Years The Net Operating.

Images References :

Source: sheelaghwbabara.pages.dev

Source: sheelaghwbabara.pages.dev

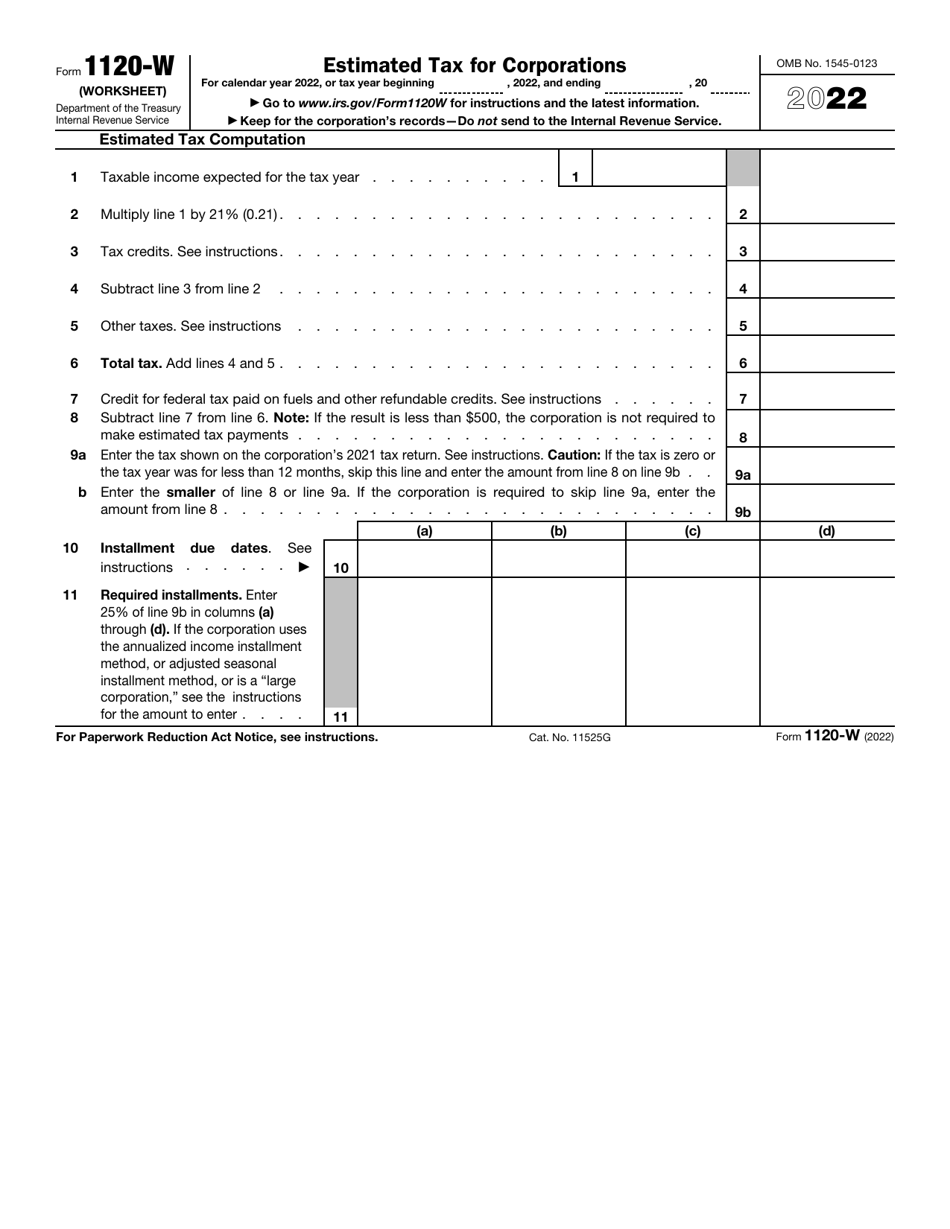

Estimated Quarterly Taxes 2024 Due Dates Schedule Dody Nadine, As the 2024 tax season approaches, it’s important to understand all the business tax deadlines related to your business and tax filings. The tax filing deadline for most businesses in the u.s.

Source: jobiqnadiya.pages.dev

Source: jobiqnadiya.pages.dev

2024 Tax Estimate Calculator Irs Kyle Tomasina, The income tax filing deadline, also known as tax day, is april 14, 2024. When to file your corporation income tax (t2) return.

Source: jolieacherish.pages.dev

Source: jolieacherish.pages.dev

Q1 2024 Estimated Tax Due Dates Ronny Cinnamon, Mark your calendar for these deadlines in 2024, based on. Individuals, sole proprietors, and c companies must file taxes on that day.

Source: marnaqkaitlyn.pages.dev

Source: marnaqkaitlyn.pages.dev

Important Tax Dates 2024 Fred Joscelin, The estimated tax payment deadlines for individuals in 2024 are as follows: Corporate installments of estimated tax payments are generally due by the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Source: brierqverina.pages.dev

Source: brierqverina.pages.dev

Estimated Tax Payments 2024 Form Berna Cecilia, Annual tax filing deadlines for 2024. However, the exceptions for tax day are:

Source: louellawhatti.pages.dev

Source: louellawhatti.pages.dev

2024 Quarterly Tax Deadlines Bunni Coralyn, For businesses structured as s corporations or partnerships, the deadline to file returns is. When you select calculate, mytax will work out your tax estimate.

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 1120W Download Fillable PDF or Fill Online Estimated Tax for, The remaining due dates are june 17 and sept. When are estimated taxes due in 2024?

Source: carinaqsandra.pages.dev

Source: carinaqsandra.pages.dev

2024 Federal Estimated Tax Due Dates Berte Melonie, The irs mandates that estimated taxes be paid quarterly. Mark your calendar for these deadlines in 2024, based on.

Source: jolieacherish.pages.dev

Source: jolieacherish.pages.dev

Q1 2024 Estimated Tax Due Dates Ronny Cinnamon, When do business taxes have to be paid? For “regular” corporations (i.e., c corporations) that operate on a calendar year, their federal income tax return for the 2023 tax year is due on april 15, 2024.

Source: philliewelayne.pages.dev

Source: philliewelayne.pages.dev

2024 4th Quarter Estimated Tax Payment Gabey Shelia, For businesses structured as s corporations or partnerships, the deadline to file returns is. These are quarterly estimated tax payment deadlines for businesses:

For Businesses Structured As S Corporations Or Partnerships, The Deadline To File Returns Is.

Due date falling on a weekend or public holiday.

First Estimated Tax Payment Due;

April 15 is commonly considered tax day.