Arkansas State Withholding Tables 2024. Calculate your annual take home pay in 2024 (that’s your 2024 annual salary after tax), with the annual arkansas salary calculator. Arkansas state income tax withholding.

Effective january 1, 2024, the supplemental rate of withholding on bonuses and other irregular wage payments is reduced from 4.7% to 4.4%. The arkansas department of revenue has released the revised withholding tax formula reflecting the changes made by sb.1 (act 2), enacted on august 11, 2022.

• Withholding Tax Formula • Withholding Tax Tables For Employers • Withholding Tax.

1, 2024, was released nov.

Withholding Tax Tables For Low Income ;

Early indications show that this trend is likely to continue in 2024.

A Quick And Efficient Way To Compare Annual.

Images References :

Source: kayqdarelle.pages.dev

Source: kayqdarelle.pages.dev

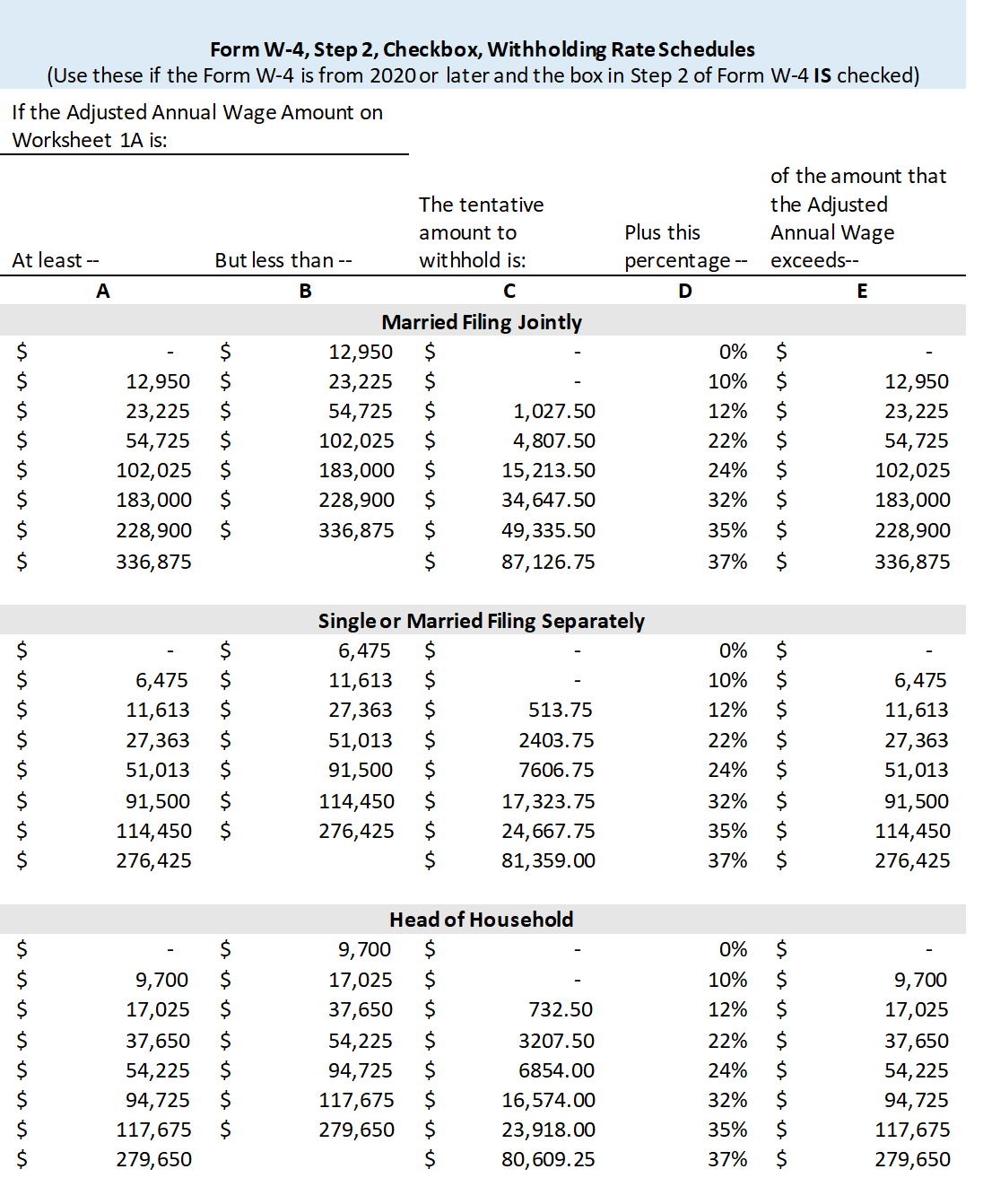

2024 Tax Brackets And How They Work Ericka Stephi, Calculate your annual take home pay in 2024 (that’s your 2024 annual salary after tax), with the annual arkansas salary calculator. The following updated withholding formula and tax tables are effective june 1, 2023:

Source: www.employeeform.net

Source: www.employeeform.net

Arkansas Employee Tax Withholding Form 2024, • withholding tax formula • withholding tax tables for employers • withholding tax. A quick and efficient way to compare annual.

Source: melindewnanci.pages.dev

Source: melindewnanci.pages.dev

Arkansas Tax Tables 2024 Maure Shirlee, 2 following an income tax cut passed in a legislative special. Early indications show that this trend is likely to continue in 2024.

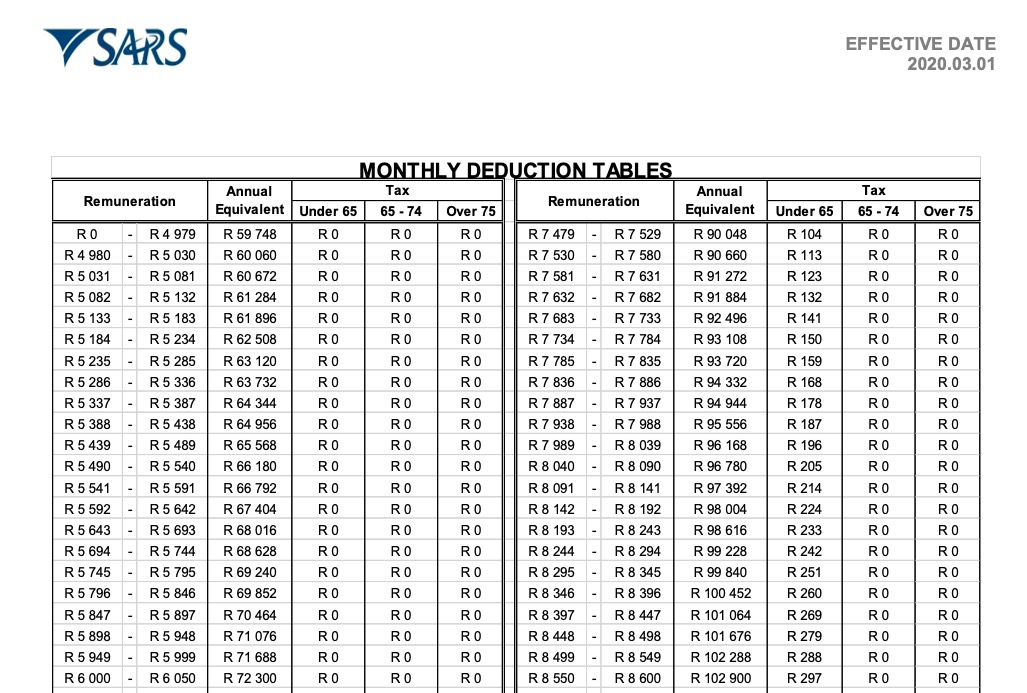

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, A quick and efficient way to compare annual. Updates to this chart will be available in our 2024 employment tax rates and limits report, anticipated.

Source: taxfoundation.org

Source: taxfoundation.org

Arkansas Lawmakers Enact Middle Class Tax Cut, Withholding tax instructions for employers (effective 01/01/2024) 01/22/2024: 34 states have 2024 state tax changes taking effect on january 1st, including state income tax changes and state business tax changes.

Source: brokeasshome.com

Source: brokeasshome.com

arkansas tax table, Withholding tax tables for employers (effective 01/01/2024) 11/02/2023: Calculate payroll costs for up to 20 employees in arkansas in 2024 for free (view alternate tax years available).

Source: brokeasshome.com

Source: brokeasshome.com

What Are The Withholding Tax Tables For 2021, 2 following an income tax cut passed in a legislative special. Arkansas’ withholding formula effective jan.

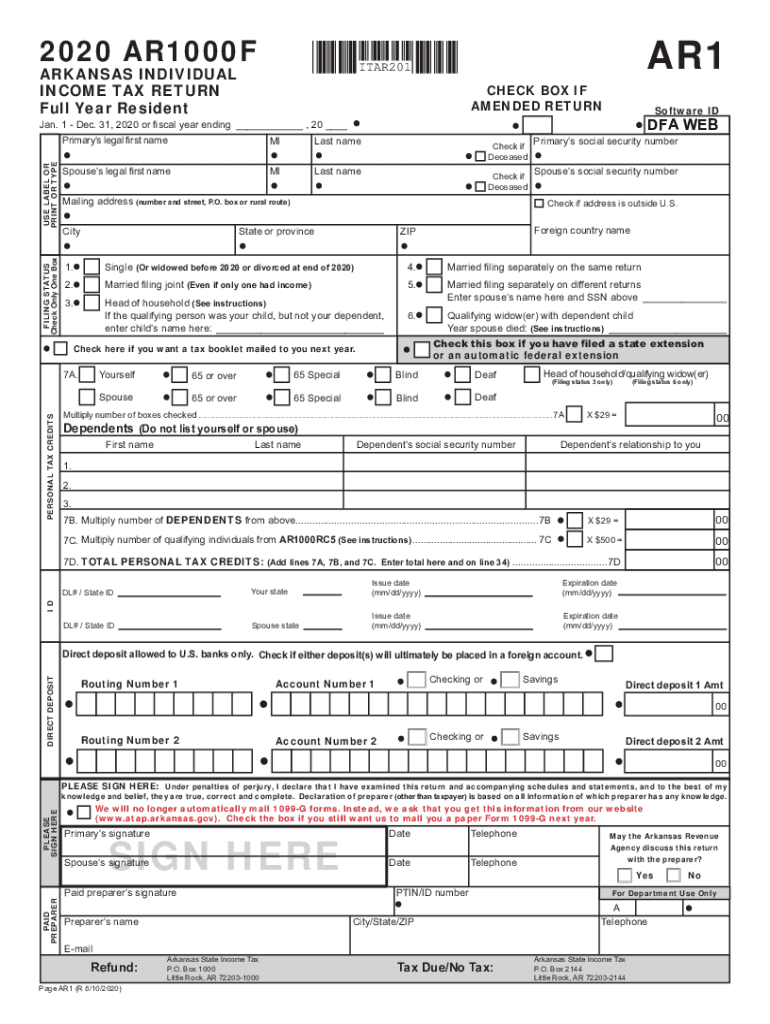

Source: www.signnow.com

Source: www.signnow.com

Arkansas State Tax 20202024 Form Fill Out and Sign Printable PDF Template airSlate, How to calculate 2024 arkansas state income tax by using state income tax table. Withholding tax tables for low income.

Source: elchoroukhost.net

Source: elchoroukhost.net

Tax Withholding Tables For Employers Elcho Table, The arkansas department of revenue has released the revised withholding tax formula reflecting the changes made by sb.1 (act 2), enacted on august 11, 2022. Early indications show that this trend is likely to continue in 2024.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, The following updated withholding formula and tax tables are effective june 1, 2023: This page has the latest arkansas brackets and tax rates, plus a arkansas income tax calculator.

The Arkansas Department Finance And Administration Released Revised Income Tax Withholding Wage Bracket Tables, Low Income Tax Tables, And Withholding Formula.

Arkansas' 2024 income tax ranges from 2% to 4.9%.

1, 2024, Was Released Nov.

This page has the latest arkansas brackets and tax rates, plus a arkansas income tax calculator.